Stepping into a director’s seat in a British company means accepting a role that shapes not only day-to-day management but also the future of the entire organisation. For new directors and SME owners, understanding the difference between executive and non-executive responsibilities is essential. This guide highlights the core duties, legal obligations and practical challenges faced by company directors, offering clear explanations for those seeking confident and compliant leadership in the United Kingdom.

Table of Contents

- Defining the Company Director Role in the UK

- Types of Directors and Key Differences

- Legal Duties Under the Companies Act 2006

- Practical Responsibilities and Day-to-Day Tasks

- Risks, Liabilities and Common Pitfalls

- Director Appointment, Removal and Compliance Essentials

Key Takeaways

| Point | Details |

|---|---|

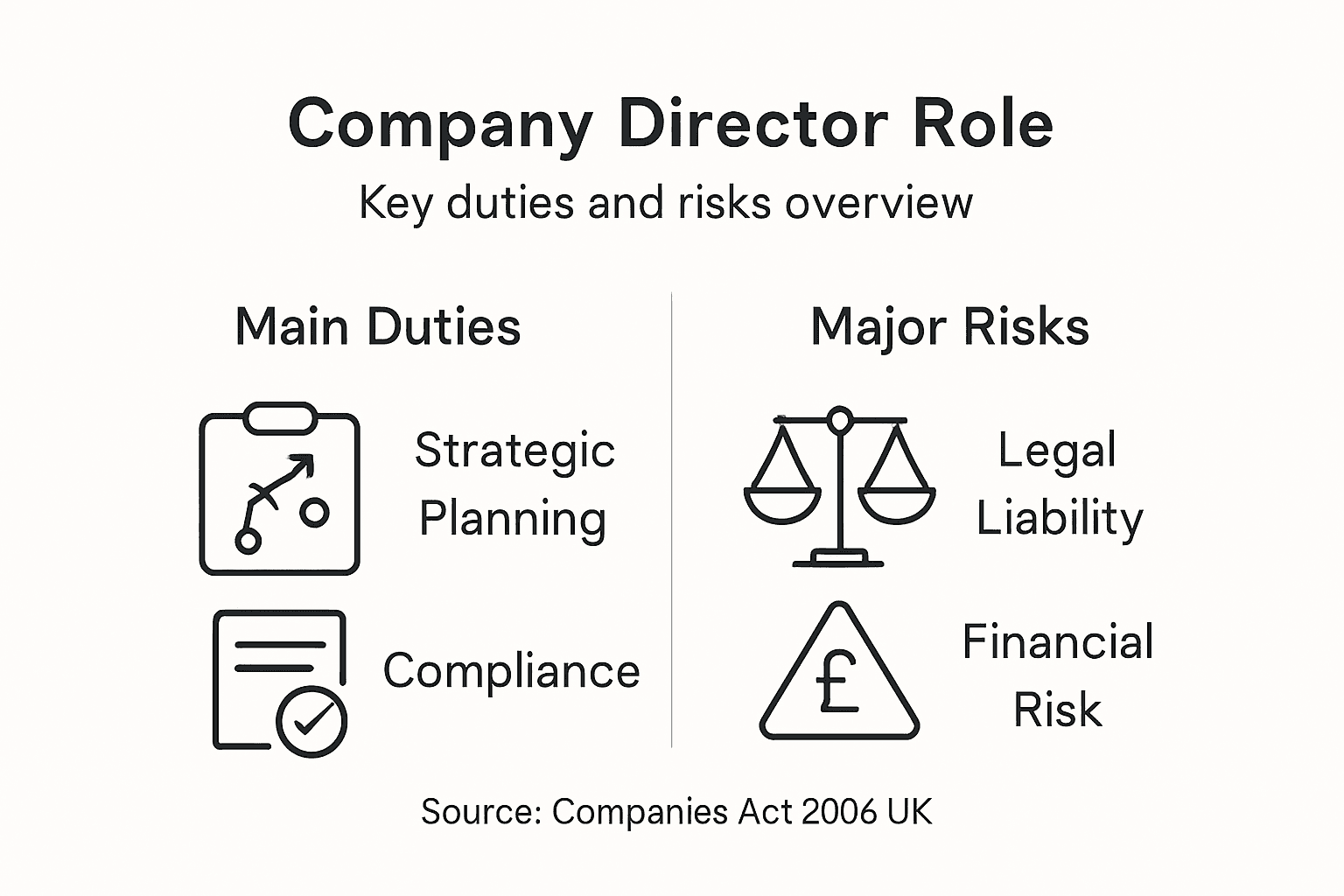

| Role of Company Directors | Company Directors in the UK are responsible for strategic direction, legal compliance, and protecting shareholder value. |

| Types of Directors | There are Executive Directors who manage daily operations and Non-Executive Directors who provide independent oversight. |

| Legal Duties | Directors must adhere to statutory obligations, including promoting company success and avoiding conflicts of interest. |

| Risk Management | Directors should implement robust governance frameworks and maintain comprehensive documentation to mitigate legal and financial risks. |

Defining the Company Director Role in the UK

In the United Kingdom, a company director plays a pivotal role in managing and steering an organisation’s strategic direction. Senior managers with legal responsibilities) are entrusted with critical decision-making powers that significantly impact the company’s performance and governance.

The role of a company director encompasses several fundamental responsibilities:

- Legal oversight and compliance with corporate regulations

- Strategic planning and business development

- Financial management and accountability

- Representing the company’s interests

- Protecting shareholder value

Directors in the UK can be classified into two primary categories:

- Executive Directors: Involved in daily operational management

- Non-Executive Directors: Providing independent oversight and strategic guidance

Under the Companies Act, there are no specific age restrictions for becoming a director, which means individuals can potentially assume this role at different stages of their professional journey. A single person can even hold multiple roles such as director and company secretary.

Responsibilities and Legal Obligations

Company directors must adhere to several critical legal obligations:

- Act in good faith and in the company’s best interests

- Maintain proper financial records

- Comply with statutory reporting requirements

- Exercise reasonable care and skill in decision-making

- Avoid conflicts of interest

A company director’s actions directly influence the organisation’s success, reputation, and long-term sustainability.

Pro tip: Always maintain comprehensive documentation of board decisions and ensure transparent communication with stakeholders to mitigate potential legal risks.

Types of Directors and Key Differences

In the complex landscape of corporate governance, company directors are not a monolithic group but rather represent diverse roles with distinct responsibilities. Directors fall into specific categories that play crucial parts in organisational management and strategic decision-making.

The primary types of directors include:

- Executive Directors: Actively involved in daily operational management

- Non-Executive Directors: Providing independent strategic oversight

- Inside Directors: Internal company representatives

- Outside Directors: Independent external perspectives

Executive vs Non-Executive Directors

The following table distinguishes the core characteristics of executive, non-executive, inside, and outside directors for quick reference:

| Director Type | Main Focus | Organisation Ties | Role in Board Dynamics |

|---|---|---|---|

| Executive Director | Daily management | Employed by company | Implements strategy, reports daily |

| Non-Executive Director | Independent oversight | External appointment | Challenges and guides management |

| Inside Director | Internal representation | Senior company personnel | Connects operations with board |

| Outside Director | External perspective | Independent professional | Provides unbiased advice |

Executive Directors are typically full-time employees who:

- Manage daily business operations

- Implement strategic decisions

- Report directly to the board

- Have in-depth knowledge of company processes

- Participate actively in management meetings

Non-Executive Directors, by contrast, offer independent board leadership by:

- Providing external, unbiased perspectives

- Monitoring company performance

- Challenging management strategies

- Representing shareholder interests

- Contributing specialised expertise

Independent directors bring critical external insights that challenge internal thinking and prevent potential organisational blind spots.

Pro tip: Carefully balance board composition by ensuring a mix of executive and non-executive directors to maintain robust corporate governance and diverse strategic perspectives.

Legal Duties Under the Companies Act 2006

The Companies Act 2006 represents a comprehensive legislative framework that precisely defines the legal responsibilities of company directors in the United Kingdom. Directors’ duties are systematically codified to ensure transparent and accountable corporate governance.

Under this pivotal legislation, directors are mandated to fulfil seven fundamental statutory duties:

- Act within Powers: Operate strictly according to company constitution

- Promote Company Success: Make decisions benefiting the entire organisation

- Exercise Independent Judgment: Maintain personal strategic perspectives

- Exercise Reasonable Care: Demonstrate professional diligence

- Avoid Conflicts of Interest: Prevent personal gains compromising company interests

- Refuse Unauthorised Benefits: Reject improper personal advantages

- Declare Potential Transactions: Disclose any personal financial interests

Strategic Accountability Mechanisms

Key Accountability Requirements include:

- Setting clear strategic objectives

- Monitoring organisational progress

- Appointing senior management

- Ensuring financial transparency

- Protecting shareholder interests

Corporate governance responsibilities extend beyond mere compliance, demanding proactive leadership and ethical decision-making.

Directors bear substantial legal responsibility for maintaining organisational integrity and protecting stakeholder interests.

Pro tip: Maintain comprehensive documentation of board decisions and regularly review your understanding of statutory obligations to ensure ongoing compliance.

Practical Responsibilities and Day-to-Day Tasks

Company directors play a critical role in driving organisational success through their daily strategic and operational responsibilities. Directors manage multiple critical functions that require constant attention and professional judgment.

Key day-to-day responsibilities include:

- Strategic planning and goal setting

- Financial performance monitoring

- Risk management assessment

- Compliance oversight

- Stakeholder communication

- Organisational leadership

- Decision-making and problem resolution

Strategic Oversight Functions

Board-Level Responsibilities encompass several critical tasks:

- Reviewing financial statements

- Approving major investments

- Evaluating executive performance

- Setting organisational direction

- Ensuring regulatory compliance

Corporate governance duties extend beyond routine management, requiring directors to:

- Provide comprehensive strategic oversight

- Manage potential mergers and acquisitions

- Determine executive compensation

- Organise board committee structures

- Nominate future board members

Effective directors transform daily responsibilities into strategic opportunities for organisational growth and sustainability.

Pro tip: Develop a systematic approach to tracking your daily responsibilities, using digital tools and structured reporting to maintain comprehensive oversight and accountability.

Risks, Liabilities and Common Pitfalls

Company directors face significant legal and financial risks that demand constant vigilance and strategic management. Directors must proactively identify material risks to protect both organisational and personal interests.

Common liability risks include:

- Financial mismanagement

- Regulatory non-compliance

- Inadequate risk assessment

- Breach of fiduciary duties

- Negligent decision-making

- Conflicts of interest

- Insufficient documentation

Primary Risk Categories

Directors must manage multiple risk domains:

Here’s a summary of key risks facing company directors alongside mitigation strategies for each:

| Risk Type | Potential Impact | Recommended Mitigation |

|---|---|---|

| Financial mismanagement | Fines or insolvency | Regular audits and reviews |

| Regulatory breaches | Legal penalties | Continuous compliance training |

| Reputational damage | Loss of stakeholder trust | Transparent communication |

| Strategic errors | Missed growth opportunities | Collaborative decision-making |

- Operational risks

- Financial risks

- Legal compliance risks

- Reputational risks

- Strategic investment risks

Liability risk management requires systematic approaches, including:

- Maintaining comprehensive records

- Documenting decision-making processes

- Implementing robust governance frameworks

- Conducting regular risk assessments

- Seeking professional legal advice

Personal liability can extend beyond professional boundaries, making comprehensive risk management crucial for directors.

Pro tip: Develop a structured risk management protocol and regularly review your company’s potential exposure to minimise unexpected legal and financial vulnerabilities.

Director Appointment, Removal and Compliance Essentials

Navigating the complex landscape of director appointments requires precise understanding of legal protocols and regulatory requirements in the United Kingdom. Companies must follow specific procedures when managing director transitions to ensure full legal compliance.

Key steps for director appointments include:

- Completing official Companies House forms

- Verifying candidate’s eligibility

- Conducting background checks

- Documenting appointment details

- Updating company registers

- Notifying relevant stakeholders

- Obtaining necessary approvals

Appointment Process Requirements

Directors must adhere to specific administrative procedures:

- Submit AP01 form for new director appointments

- File TM01 form for director terminations

- Update director details within 14 days of changes

- Maintain accurate company records

- Ensure compliance with Companies Act 2006

Recent legislative changes have introduced enhanced compliance obligations, including:

- Mandatory identity verification

- Enhanced register information accuracy

- Stricter reporting requirements

- More rigorous background checks

- Increased transparency measures

Director appointments are not merely administrative tasks but critical governance mechanisms that protect organisational integrity.

Pro tip: Develop a systematic onboarding and offboarding process for directors, ensuring all legal and procedural requirements are meticulously documented and executed.

Take Control of Your Company Director Responsibilities with Expert Guidance

Navigating the complex legal duties and daily responsibilities of a company director in the United Kingdom can feel overwhelming. The article highlights critical challenges such as complying with the Companies Act 2006, managing financial and reputational risks, and maintaining flawless governance. If you want to confidently act within your powers, avoid conflicts of interest, and safeguard your organisation against common pitfalls, expert insight and practical advice are essential.

Discover clear, reliable support at KefiHub, your dedicated UK platform for business and legal guidance. Start exploring essential topics like director duties and practical compliance essentials to stay ahead in your leadership role. Act now to protect your organisation and ensure every decision you make as a company director contributes to lasting success.

Frequently Asked Questions

What are the primary responsibilities of a company director?

Company directors have several key responsibilities, including ensuring legal compliance, overseeing strategic planning, managing financial performance, representing the company’s interests, and protecting shareholder value.

What types of directors exist within a company?

There are primarily two types of directors: executive directors, who manage daily operations, and non-executive directors, who provide independent oversight and strategic guidance.

What are the legal duties of a director under the Companies Act?

Directors are required to act within their powers, promote company success, exercise independent judgment, avoid conflicts of interest, and declare any potential transactions among other statutory duties.

How can directors mitigate risks associated with their role?

To mitigate risks, directors should maintain comprehensive records, conduct regular audits, ensure compliance with regulations, and seek professional legal advice when needed.

Recommended

- Why Form a Limited Company in the UK? – Kefihub

- Company Formation Explained: Key Steps for UK SMEs – Kefihub

- Why Register a UK Company – Legal and Financial Impact – Kefihub

- Company Formation Explained: Key Steps for UK SMEs – Kefihub