Forming a british company is far quicker and more affordable than most entrepreneurs expect. Nearly 80 percent of new businesses in the United Kingdom now complete registration digitally, with many set up on the same day. For UK small business owners, understanding the facts behind company formation clears away the myths and paves the way for legal protection, credibility, and commercial growth. This guide reveals how to build a solid foundation, avoid common mistakes, and meet core legal obligations with confidence.

Table of Contents

- Defining Company Formation And Common Myths

- Types Of Uk Business Structures Compared

- Core Steps In The Company Registration Process

- Legal, Tax And Compliance Essentials For Smes

- Common Pitfalls And How To Avoid Them

Key Takeaways

| Point | Details |

|---|---|

| Company Formation Benefits | Forming a company provides limited liability, legal recognition, and improved credibility, essential for attracting investors and enabling growth. |

| Streamlined Registration Process | Registering a company online can be completed in less than 24 hours, making it a quick and cost-effective option for entrepreneurs. |

| Choosing the Right Structure | Entrepreneurs should carefully consider their business structure to balance personal liability, tax implications, and growth potential. |

| Avoid Common Pitfalls | Maintaining financial separation, protecting intellectual property, and ensuring compliance with regulations are crucial to mitigate risks for new businesses. |

Defining Company Formation and Common Myths

Company formation represents the legal process of transforming a business idea into an official registered entity within the United Kingdom. Incorporating a business through Companies House involves creating a distinct legal structure that separates personal and business liabilities, offering entrepreneurs a professional pathway to commercial recognition.

At its core, company formation means establishing a separate legal identity that can trade, own assets, enter contracts, and operate independently from its founders. This process of incorporation transforms a business concept into a structured organisation governed by specific legal frameworks, primarily the Companies Act 2006. The key distinction is that a registered company becomes a “legal person” in its own right, capable of conducting business activities with its own rights and responsibilities.

Common myths about company formation often discourage potential entrepreneurs. Many believe the process is complex, time-consuming, and expensive. In reality, digital registration through Companies House can now be completed within hours, with most applications processed on the same day. Another prevalent misconception is that all company directors bear unlimited personal liability – which is incorrect. Limited companies provide significant personal asset protection, meaning shareholders typically risk only their invested capital.

Here’s a summary of the main benefits of forming a company in the UK:

| Benefit | Description | Business Impact |

|---|---|---|

| Limited Liability | Owners’ personal assets protected | Reduces financial risk for entrepreneurs |

| Legal Recognition | Separate legal entity status | Improves credibility with clients and investors |

| Commercial Flexibility | Can own assets and sign contracts | Enables diverse business opportunities |

| Clear Ownership Structure | Defined through shareholdings | Simplifies decision-making and growth planning |

- Registering a company takes less than 24 hours online

- Incorporation costs are relatively modest

- Digital platforms have simplified the entire process

- Legal protections are robust for registered businesses

Pro tip: Before registering, conduct a thorough name search to ensure your preferred company name is available and complies with Companies House regulations.

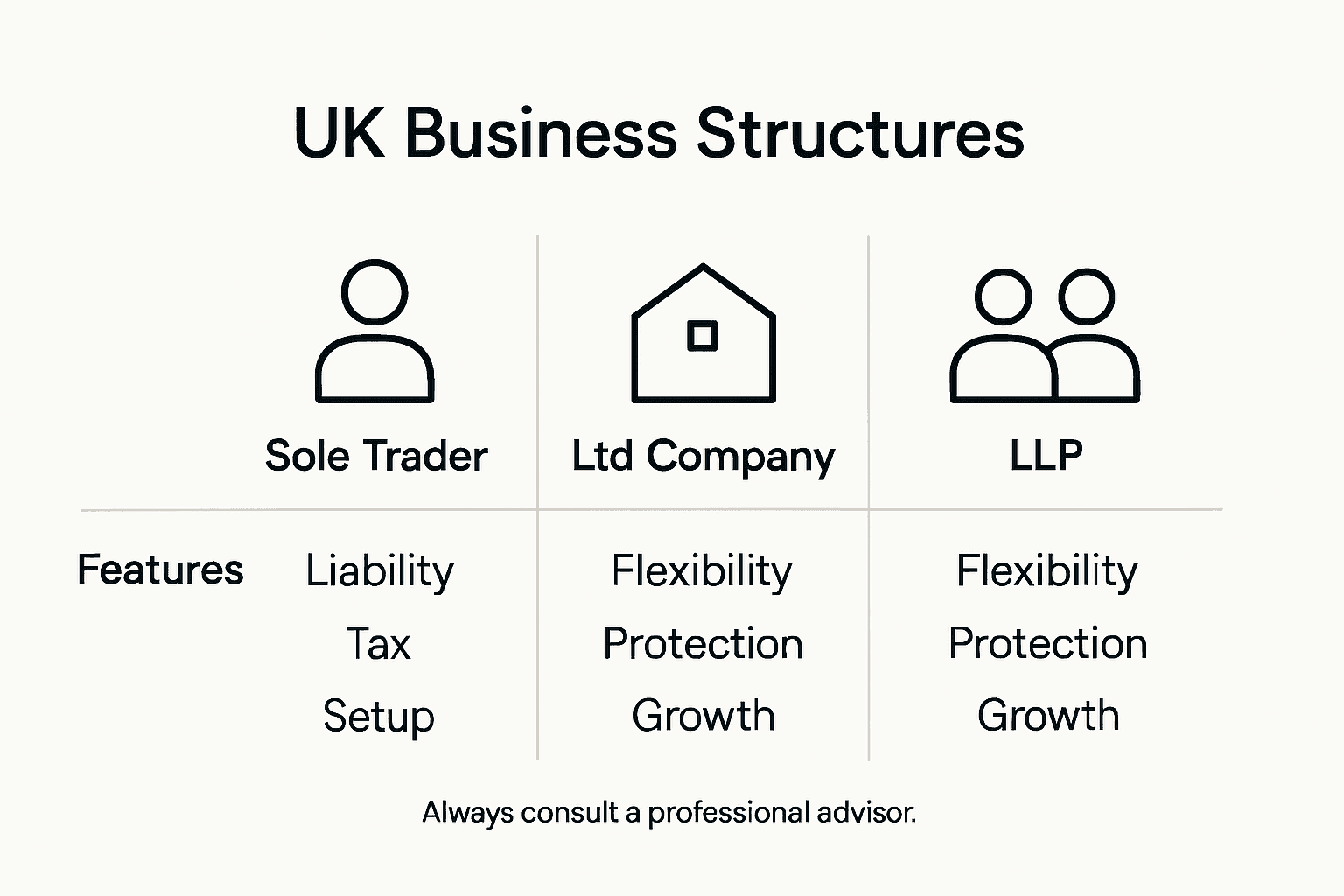

Types of UK Business Structures Compared

The United Kingdom offers several business structures for entrepreneurs, each with unique characteristics and legal implications. When selecting a business structure, founders must carefully consider factors like personal liability, taxation, administrative complexity, and growth potential.

Sole Trader represents the simplest business structure, ideal for individual professionals and small-scale operations. This model allows direct control but exposes the owner to unlimited personal liability, meaning personal assets could be at risk if the business encounters financial difficulties. Tax reporting is straightforward, with profits taxed through personal income tax returns.

Limited Companies provide a more robust framework for businesses seeking growth and investor confidence. These structures create a legal entity separate from its owners, offering limited liability protection. Shareholders’ financial risk is typically restricted to their invested capital. Limited companies can be either private (Ltd) or public (PLC), with public companies able to trade shares on stock exchanges.

Alternative structures include:

- Partnership: Shared ownership with joint financial responsibilities

- Limited Liability Partnership (LLP): Combines partnership flexibility with reduced personal risk

- Community Interest Company (CIC): Designed for social enterprises with specific community objectives

| Structure | Personal Liability | Taxation | Complexity |

|---|---|---|---|

| Sole Trader | Unlimited | Simple | Low |

| Limited Company | Limited | More Complex | Medium |

| LLP | Limited | Moderate | Medium |

Consider these factors when choosing the right UK business structure:

| Factor | Sole Trader | Limited Company | LLP |

|---|---|---|---|

| Ease of Setup | Very simple | Moderately technical | Moderate complexity |

| Ongoing Costs | Low | Higher due to filings | Moderate fees |

| Investment Potential | Limited growth options | Attractive to outside investors | Suits professional partnerships |

| Reputation | Generally more informal | Viewed as professional | Professional credibility for partners |

Pro tip: Consult an accountant or legal professional to determine the most appropriate business structure for your specific financial circumstances and long-term business goals.

Core Steps in the Company Registration Process

Registering a company in the United Kingdom involves a systematic approach designed to legally establish your business entity. The registration process through Companies House requires careful preparation and attention to specific documentation and legal requirements.

Company Name Selection represents the critical first step in the registration journey. Your chosen name must be unique, compliant with Companies House regulations, and not infringe on existing trademarks. Entrepreneurs should conduct thorough searches to ensure name availability and avoid potential legal complications. The name will become your business’s primary legal identifier, so choosing wisely is paramount.

Key Registration Documentation typically includes preparing crucial paperwork such as the memorandum of association and articles of association. These foundational documents outline the company’s operational framework, governance structure, and fundamental rules. Directors must provide comprehensive personal details, including full legal names, addresses, and identification information. Additionally, you’ll need to identify and document persons with significant control (PSC), who hold substantial ownership or voting rights within the organisation.

The registration process can be completed through two primary channels:

- Online registration via Companies House website

- Paper-based registration by postal submission

| Registration Method | Processing Time | Complexity | Cost |

|---|---|---|---|

| Online Registration | 24 hours | Low | Standard fee |

| Postal Registration | 10-14 days | Medium | Standard fee |

Pro tip: Prepare all required documentation in advance and double-check personal details to expedite the company registration process and avoid potential delays.

Legal, Tax and Compliance Essentials for SMEs

Navigating the complex landscape of legal and regulatory requirements is crucial for UK small and medium enterprises (SMEs) seeking sustainable growth. Small businesses must stay vigilant about evolving compliance standards, which encompass a wide range of critical areas from employment law to financial reporting.

Tax Compliance represents a fundamental aspect of business management. The Making Tax Digital (MTD) initiative requires businesses to maintain digital tax records and submit returns electronically, transforming traditional accounting practices. Limited companies must register for Corporation Tax within three months of starting business activities, and maintain accurate financial documentation to ensure transparent reporting and avoid potential penalties.

Employment law introduces another layer of complexity for SMEs. Businesses must carefully navigate regulations surrounding worker rights, including minimum wage requirements, workplace discrimination protections, and health and safety standards. Key compliance areas include maintaining proper employment contracts, implementing fair disciplinary procedures, and ensuring workplace equality. Payroll systems must be robust, with accurate record-keeping of employee payments, tax deductions, and pension contributions.

Critical Compliance Checklist:

- Maintain up-to-date digital tax records

- Implement comprehensive HR policies

- Conduct regular health and safety assessments

- Stay informed about legislative changes

- Ensure data protection and privacy protocols

| Compliance Area | Key Requirements | Potential Penalties |

|---|---|---|

| Tax Reporting | Digital records | Fines up to £3,000 |

| Employment Law | Fair contracts | Tribunal claims |

| Data Protection | GDPR compliance | Significant fines |

Pro tip: Consider investing in professional compliance management software or consulting with a legal expert to ensure your SME remains fully compliant with evolving regulatory requirements.

Common Pitfalls and How to Avoid Them

Navigating the complex landscape of company formation requires strategic awareness and proactive planning. Understanding common mistakes during business establishment can save entrepreneurs significant time, financial resources, and potential legal complications.

Financial Separation represents a critical area where many small business owners stumble. Mixing personal and business finances creates substantial accounting challenges and potential legal risks. Entrepreneurs should establish a dedicated business bank account immediately upon company registration, ensuring clear financial boundaries. This practice not only simplifies tax reporting but also protects personal assets by maintaining a distinct legal and financial separation between individual and corporate finances.

Intellectual property (IP) protection often falls victim to overlooked documentation and registration processes. Many SMEs fail to properly safeguard their innovative ideas, designs, and brand identities. Comprehensive IP protection involves strategic trademarking, understanding copyright regulations, and potentially registering patents for unique innovations. Early legal consultation can help identify which IP assets require formal protection and develop a robust strategy for defending intellectual property rights.

Key Pitfalls to Avoid:

- Neglecting proper financial record-keeping

- Inadequate IP protection strategies

- Failing to separate personal and business finances

- Overlooking compliance requirements

- Underestimating tax reporting obligations

| Potential Pitfall | Potential Consequence | Recommended Action |

|---|---|---|

| Mixed Finances | Legal and Tax Risks | Separate Bank Accounts |

| IP Vulnerability | Loss of Rights | Early Registration |

| Poor Record-Keeping | Compliance Penalties | Systematic Documentation |

Pro tip: Invest in professional accounting software and consider an initial consultation with a business lawyer to create a comprehensive risk mitigation strategy for your new company.

Take Control of Your UK Company Formation Journey with Expert Guidance

Starting a business in the United Kingdom comes with many challenges such as choosing the right business structure, managing legal compliance and protecting your personal assets. This article highlights critical concepts like limited liability, company registration, and tax compliance which can feel overwhelming without clear direction. If you want to avoid common pitfalls and confidently navigate the registration process, professional insights tailored to UK SMEs are essential.

Discover practical advice and expert commentary on these topics and more at KefiHub. From understanding your legal obligations to ensuring your business name complies with regulations, we help UK entrepreneurs build strong foundations with clarity and confidence. Act now to secure your company’s future by exploring our straightforward guides and actionable resources. Start your company formation journey the smart way with KefiHub. Visit our landing page today to gain the knowledge that empowers your success.

Frequently Asked Questions

What is company formation?

Company formation is the legal process of creating a registered business entity, which separates personal and business liabilities, allowing the venture to operate independently with specific rights and responsibilities.

How long does it take to register a company in the UK?

Registering a company online through Companies House can be completed in under 24 hours, with most applications processed on the same day.

What are the benefits of forming a limited company?

Forming a limited company offers several advantages including limited liability protection for owners, legal recognition as a distinct entity, greater commercial flexibility, and a clear ownership structure.

What common mistakes should I avoid when forming a company?

Common mistakes include mixing personal and business finances, failing to protect intellectual property, neglecting proper financial record-keeping, and overlooking compliance requirements like tax reporting.

Recommended

- Why Build a Website: Boosting UK Small Businesses – Kefihub

- Starting a Small Business UK: Step-by-Step Legal Guide – Kefihub

- What Is Business Succession and Why It Matters – Kefihub

- Small Business Compliance Guide: Essential Steps for UK SMEs – Kefihub

- Computer Security: Safeguarding Brisbane SMEs – IT Start